Authors: Deborah Snyder, Research Grants & Contracts, drjack2 @emory.edu and Tricia Callahan, Research Training, tricia.callahan @emory.edu

If you work with faculty on a 9-month appointment or another contract type that is not 12 months (e.g., 10 months), knowing how to annualize their Institutional Base Salary (IBS) for calculating effort is essential, as most agencies require that effort be reported annually.

For example, Dr. Smith is on a 9-month appointment. His IBS is $90,000. This means Dr. Smith is compensated for his work/effort performed over the 9-months of the academic year. His IBS amount is paid over 12 months. This also means Dr. Smith is free to earn income during his non-contracted time (i.e., 3 summer months).

IBS is seen in PSoft H/R. If you’re unsure of the appointment type, contact the PI or Department. For a faculty on a 9-month appointment, like Dr. Smith, annualizing IBS means calculating the total amount of annual salary they would make if they devoted additional effort and received compensation during the remaining 3 months of their contracted time.

Let’s use an example to demonstrate this concept:

Dr. Smith has a 9-month academic year appointment. His IBS of $90,000 is compensation for his work/effort during the 9 months of the academic year, equating to an IBS rate of $10,000 per month ($90,000/9). Since we know that Dr. Smith’s IBS rate is $10,000 per month, if he worked for the 3 summer months, he could earn another $30,000 ($10,000*3) during his non-contract time. His total annual salary would be $120,000. ($90,000 + $30,000)

Per Uniform Guidance (200.430 (h)(5)(i)), “charges for work performed during periods not included in the base salary period will be at a rate not in excess of the IBS.” This means faculty on a 9-month academic year appointment committing effort during the summer months cannot request compensation at a rate higher than their IBS. For Dr. Smith, this means he cannot earn more than $30,000 over the summer.

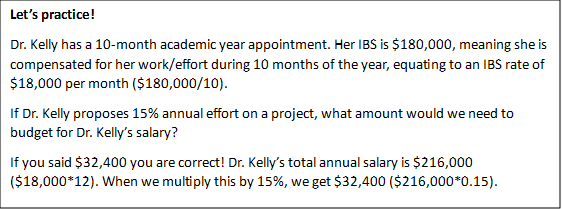

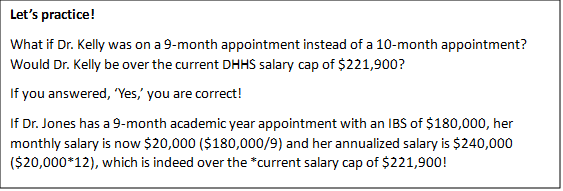

Another situation in which we need to consider annualized salary is determining if an individual is over any sponsor or program salary cap. In the example with Dr. Kelly, her 10-month IBS is $180,000. This equates to an annual salary of $216,000 (monthly salary of $18,000*12 months). In this case, Dr. Kelly is not over the *current DHHS salary cap of $221,900.

For more on when, why, and how to annualize salary, check out the recording from the recent Boot Camp: Annualized Salary – What is it and why is it so important? (https://emory.brainier.com/#/object/2143). Access by first opening Brainer and then clicking on the link provided.

*$221,900 is the DHHS salary cap in place when this article was published. The salary cap changes annually. Refer to the appropriate cap when determining if salary exceeds the set cap.

Leave a Reply