About Myself

My name is Yining Feng and I am a junior majored in Economics in the Emory College. I am also minored in Predictive Health, and I have been a pre-med student for 2 years at the Oxford College of Emory University. I am considering pursuing the dgree of doctor of dental surgery (DDS) or a master of business administration (MBA). If there is a joint degree program DDS/MBA avaible, then I am planning on pursuing both degrees simultaneously.

My Research

I am currently assisting Dr. Jeong Ho Kim with his research project on the Measuring Mutual Funds skills, with a particular focus of the Chinese Mutual Funds Market. The research project is devised to study the assest management industry, and research the industrial organization implications of trend chasing by mutual fund investors. The economics term mutual fund refers to an investment company that brings together money from many investors and invests it in stocks, bonds or other assets.1 The combined holdings of these underlying assets the fund owns are known as its portfolio. Each investor in the fund owns shares, which represent a part of these holdings. 1 My tasks during the first stage of the research include reviewing related literature, collecting organizing, and cleaning data about Chinese Mutual Funds Market from the Wharton Research Data Services (WRDS) website. I have learnt and enhanced my skill of using Stata or R software for data cleaning throughout this process. In the second stage of the research, I am expected to run regressions and estimate models for the data of Mutual Funds.

What has previous research shown?

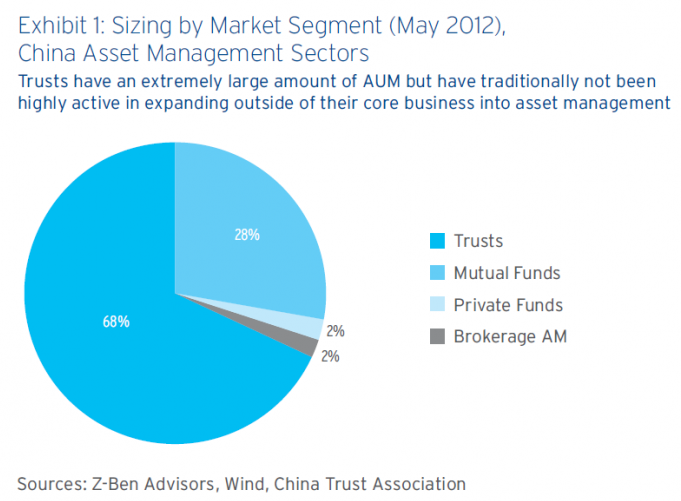

The data collected by Citibank in 2012 suggest that 28% of China’s financial assets under management (AUM) are held in mutual funds (Exhibit 1). The Chinese Mutual Funds Market is still under the developing stage due to the lack of market participation of Chinese people with huge amounts of saving. 2 Nevertheless, the Chinese assest management industry still displays a bright future because of the increasing interest from outside the industry both from foreign financial firms and large domestic corporations as passive investors. 2 The distribution structure of the Chinese market emphasizes the culture of short-term trading. The tendency of short-term mentality among Chinese investors leads to a significantly different business model for the Chinese fund industry compared with the American industry. While U.S. investment managers have carefully considered fund launches, the Chinese industry has constantly created new funds since 2010. 3

Current Outlook of the Chinese Mutual Funds Market

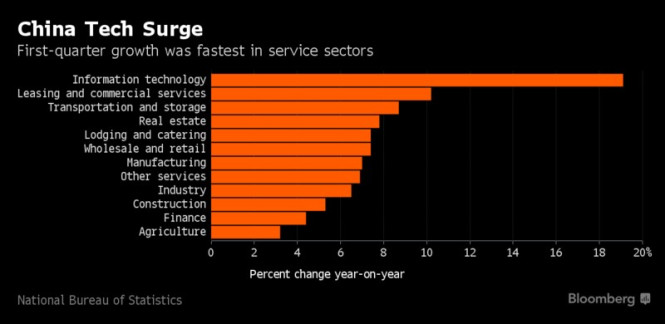

The Chinese economy has maintained a stable growth since 2014, as evidenced by the constant GDP annual growth rate around 7% (Exhibit 2). The steady growth of the economy is attributed to an industrial sector recovery, strong credit growth, fast-growing information technology sector and a booming real estate sector.4

Overall, the output of services has accounted for more than half of the Chinese economy since 2015. The 2017 report by the National Bureau of Statistics suggests that commercial leasing, transportation and storage, as well as the information technology sectors together account for the biggest source of Chinese economic growth. The 19.2% growth rate of the information technology sector is ranked the highest during the 1st quarter of 2017; the 8.8% growth rate of the transportation and storage sector is preceded by the second highest growth rate of 10.1% in the leasing and commercial services sector; the growth rate of the real estate sector also reached 7.9%; both the lodging & catering sector and the retail and wholesale sector rose 7.4% at the fastest pace ever since 2014 (Exhibit 3).4

Data Collection and Cleaning

There are three basic types of mutual funds including equity funds that invest in stocks, fixed-income funds that invest in bonds, balanced funds that invest in both stocks and bonds, and money market funds that seek the risk-free rate.5 The data cleaning process began with identifying duplicates based on specific characteristics for distinguishing between variable subsets.The duplicates report generated by the Stata software showed that there were in total 185 unique mutual funds with complete investment concentration data available since 1998. During the sample selection and information processing procedures, invalid data were excluded from the analysis. The historical data, including data on value-weighted stock index monthly returns and investment concentration, were obtained from the WRDS database.

Stata Duplicate Report Example

(1) Use the data from File 1 “Funds Main Info” and base the duplicate count solely on the variable “Fund ID“. Start by running the duplicates report command to see the number of duplicate rows in the dataset. This is followed by duplicate reports id, which gives the number of replicate rows by the variables specified; in this instance we have just “fundid”. We could have used the duplicates examples command instead of the duplicates report command. The duplicates examples command lists one example of each duplicated set.

use "C:\Users\jkim230\Dropbox\Data\csmar\fund_maininfo.dta", clear

duplicates report fundid

*

* Duplicates in terms of fundid

*

* --------------------------------------------------------

* copies | observations surplus

* -------+------------------------------------------------

* 1 | 1552 0

* --------------------------------------------------------

**********************************************************

(2) Use the data from File 2 “Fund Unit Class Info” and base the duplicate count solely on the variable “Fund Class ID“. The subsequent procedure is the same as step (1).

use "C:\Users\jkim230\Dropbox\Data\csmar\fund_unitclassinfo.dta", clear

duplicates report fundclassid

*

* Duplicates in terms of fundclassid

*

* -------------------------------------------------------------

* copies | observations surplus

* ------ +-----------------------------------------------------

* 1 | 3120 0

* -------------------------------------------------------------

by fundclassid fundid, sort: gen nvals = _n==1

by fundclassid: replace nvals = sum(nvals)

by fundclassid: replace nvals = nvals[_N]

su nvals

*

* Variable | Obs Mean Std. Dev. Min Max

-----------+-----------------------------------------------------

* nvals | 3,120 1 0 1 1

*****************************************************************

use "C:\Users\jkim230\Dropbox\Data\csmar\fund_maininfo.dta", clear

(3) Merge the mutual funds data from File 1 with that of File 2. Merge is for adding new variables from a second dataset to existing observations. Perform the command of one-to-many merge on specified key variables.

merge 1:m fundid using "C:\Users\jkim230\Dropbox\Data\csmar\fund_unitclassinfo.dta"

*

* Result # of obs.

* ---------------------------------------------------------------

* not matched 819

* from master 0 (_merge==1)

* from using 819 (_merge==2)

*

* matched 2,301 (_merge==3)

* ---------------------------------------------------------------

save "C:\Users\jkim230\Dropbox\Data\csmar\asdf.dta", replace

*****************************************************************

use "C:\Users\jkim230\Dropbox\Data\csmar\fund_promoter.dta", clear

(4) The command duplicates report of the merged file shows that there are 185 unique fundid values.

duplicates report fundid declaredate institutionid

*

* Duplicates in terms of fundid declaredate institutionid

*

* ----------------------------------------------

* copies | observations surplus

* ----------+-----------------------------------

* 1 | 185 0

* ----------------------------------------------

***************************************************************

Future Directions:

The second stage of the research is to run regressions and esetimate models describing Chinese mutual funds managers’ abilities of stock-picking and market-timing based on the comparison of the effects of performance persistence between concentrated mutual funds and diversified mutual funds. The first step is to test whether the managers of concentrated equity mutual funds have greater stock-picking abilities than do diversified equity mutual funds based on regressions and models used to estimate the stock-picking abilities of mutual fund managers.

References

- “Mutual Funds.” SEC Emblem, U.S. Securities and Exchange Commission, 14 Dec. 2010, www.sec.gov/fast-answers/answersmutfundhtm.html.

- Sahai, Neeraj, and Peter L. Alexander. “Asset Manangement Overview.” China: The World’s Best Opportunity for Assest Managers?, 12 June 2012, pp. 7–11., www.citibank.com/transactionservices/home/about_us/articles/docs/china_asset.pdf.

- Hamacher, Theresa, and Robert C. Pozen. “In China, Big Opportunities for Investors, If Mutual Funds Can Find a Way In.” Brookings, Brookings, 28 July 2016, www.brookings.edu/opinions/in-china-big-opportunities-for-investors-if-mutual-funds-can-find-a-way-in/.

- Vickery, Mark. “3 China Mutual Funds To Buy As The Economy Expands In Q1.” Seeking Alpha, Zacks Investment Research, 20 Apr. 2017, seekingalpha.com/article/4063680-3-china-mutual-funds-buy-economy-expands-q1.

- Chen, H., & Chen, L. (2017). An Analysis of the Investment Concentration of Equity Mutual Funds in China. 53(3), 511-520. doi:10.1080/1540496X.2015.1093846

This is a very good post.

You should be aware there is a student group called ‘China Health Economics and Policy Association’ on campus. They are a grad student group but they probably would welcome you. I don’t know how much they actually get into the economics, but if your research continues they may be a group interested in talking to you at some point.

My guess, since it’s Emory, they focus mostly on the health stuff with a little bit of how does the economy change the health outlook. Still worth letting you know about.

Thank you so much for the information, Michael. I really appreciate it. I will definitely look into the Emory ‘China Health Economics and Policy Association’ group. ^_^

This post was lots of fun to read. I am curious whether or not you know how WRDS collects its data? It seems like this would be a massive task–it’s a question I’ve always asked myself.

I really like the details and organization of your post! It’s a lot of effort and work already been put in for the project. The figures are clearly labeled. I was curious, knowing that the mutual fund market in China is still developing and the regulations in China may be less mature or transparent, do you think there might be some policy-related variables that interfere with your results? If so how do you control for them?

I’m majoring in economics as well, so I found this very interesting, particularly because China has maintained such a high and consistent growth rate for some past years. I also had only read of China’s export based economy and was unaware that the IT and real estate sectors had played such a large part in the growth of the economy. I wonder why the wealthy have been hesitant to invest their savings. Is this some cultural attitude, or is not as encouraged by Chinese policy?