Introduction and Motivation

Previous economic research has shown various economic and public health benefits of immigration policies such as Deferred Action for Childhood Arrivals (DACA) or the Development, Relief, and Education for Alien Minors (DREAM) Act. In particular, DACA is a 2012 U.S. immigration policy that provided renewable work permits and freedom from deportation for a large number of undocumented immigrants. It is suggested to potentially improve the social welfare through four potential social determinants: economic stability, educational opportunities, social and community contexts, and access to health care.1 Accordingly, the termination of DACA by the Trump Administration in September 2017 has caused widespread sensation all over the U.S. As an international student, I was not familiar with the impact of immigration on the social welfare as well as the weight of such a monumental immigration policy in the hearts of U.S. population. Therefore, I want to investigate the economic and health outcomes of immigration on the well-being of U.S. natives in order to better understand the necessity of immigration policies of DACA and DREAM Act.

My original research with a concentration on the impact of immigration on the well-being of U.S. natives in terms of labor market competition and subjective well-being is inspired by the research on Happiness Economic by the 2015 Economics Nobel Prize recipient Sir Angus Deaton. According to Sir Angus Deaton’s research, economic growth is interrelated with subjective well-being (SWB). An analysis of the Gallup-Healthways Well-Being Index from 2008-2013 indicated the positive correlation between life evaluation and income.2 Furthermore, the study also suggests that the effects of economic growth on happiness are different in developed and developing countries. In a prospective study, I was inspired to investigate the impact of immigration on the well-being of U.S. natives across all states. The purpose of this study is to investigate how the spatial concentration of immigrants affects the life satisfaction of U.S. natives. The individual-level data on life satisfaction would be gathered from Gallup-Healthways Well-Being Index (GHWBI) poll and the data on immigrant population distribution would be collected from the Migration Policy Institute (MPI) Data Hub. On the other hand, the data on the U.S. population distribution across different age groups would be gathered from the Henry J. Kaiser Family Foundation Database, which is based on analysis of the Census Bureau’s March Current Population Survey. This study intends to examine the effect of immigration directly on the welfare of natives through constructing a linear regression model and plots of subjective well-being (SWB) against the regional statistics of MPI data. In addition, I intend to extract data on local unemployment rates, GDP, as well as the measure of life satisfaction by the Likert scale on ease of living, happiness, loneliness, and interest in life across all U.S. states.

Previous Research Findings

Economists have long focused on the impact of immigration on natives’ labor market outcomes such as wages and employment, which are objective measures of “welfare”. The typical approach has been to correlate these measures with the share of immigrants in local labor markets. The empirical evidence to date is rather mixed. For instance, while Borjas (2003) 3 finds negative effects of immigration on the wages of natives in the US, others find that the impact of immigration, if any, is negligible (Card, 1990, 2001) 4,5. More recently, Ottaviano and Peri (2012) 6document immigration as having a positive effect on the wages of high-skilled natives, and a negative effect on low-skilled natives. A longitudinal study in the UK finds minor impacts on unemployment, participation and wages – both economically and statistically (Dustmann et al., 2005) 7. Conversely, Manacorda et al. (2012) 8 find that since immigrants and natives are complements in production, there is no negative wage effect on the latter. However, the authors also find evidence that newly-arrived immigrants are substitutes in production with immigrants already residing in the UK. Analyzing the impact of immigration on the employment rates of native Germans, Pischke and Velling (1997) 9 find that immigration does not adversely impact natives’ employment. More recently, D’Amuri et al. (2010) 10 analyze both the wage and employment effects of immigration in West Germany, finding that immigration has essentially no impact on natives’ labor market outcomes, but has an adverse effect on previous immigrants.

Another strand of the literature has explored the impact of immigration on other outcomes while still using objective measures of welfare. For example, Dustmann et al. (2010) 11 analyze whether the immigration stemming from the EU enlargement toward Eastern Euro- pean countries affected UK public finances. They find that immigrants from the accession countries positively contributed to public finances, since they were found relatively more likely to be in work than natives, and less likely to access social benefits.

Finally a branch of the literature has started to explore the relationship between immigration and natives’ attitudes. For example, Card et al. (2005) 12 analyze European Social Survey data and conclude that while attitudes towards immigrants are partially shaped by economic factors, other aspects such as culture, and natives’ social status are important in affecting the way in which immigration is perceived. Moreover, Boeri (2010) 13 argues that the business cycle influences natives’ opinions towards immigrants. Other studies investigate the determinants of attitudes toward immigrants 14.

Methods

- The individual-level data of subjective well-being (SWB) variable is derived from responses of the question “Are you satisfied or dissatisfied with your standard of living?” in the Gallup Healthways Survey, which allows responses on an ordinal scale from 0 to 100.

- Gather state-level data on immigrant population through the demographic online research tool Social Explorer.

- Extract state-level data on local unemployment rates and the median household income levels through the Social Explorer online tool.

- Aggregate all the datasets into the the state-level data, and compile them for the same year.

- Construct a multiple linear regression model by using Stata.

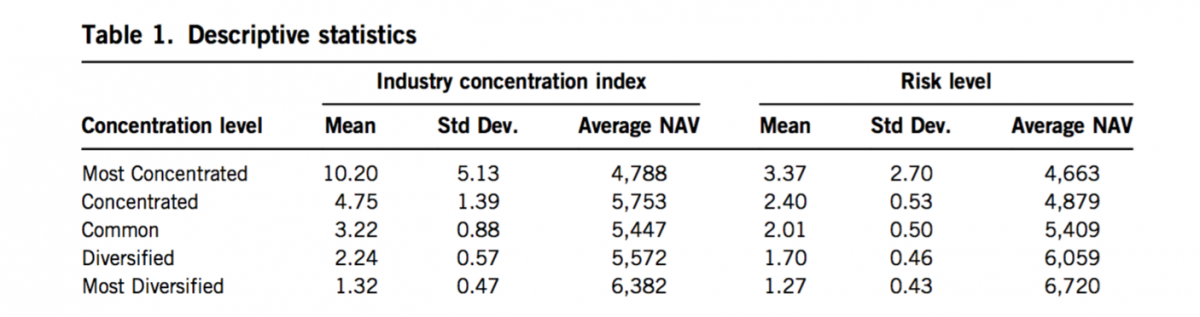

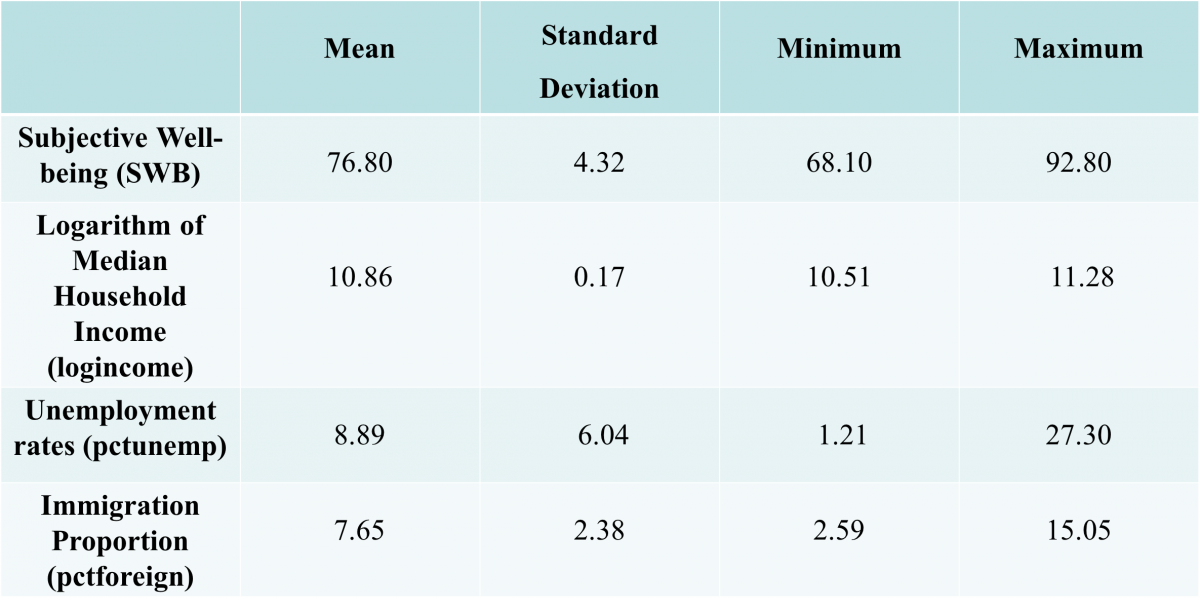

Data Analysis

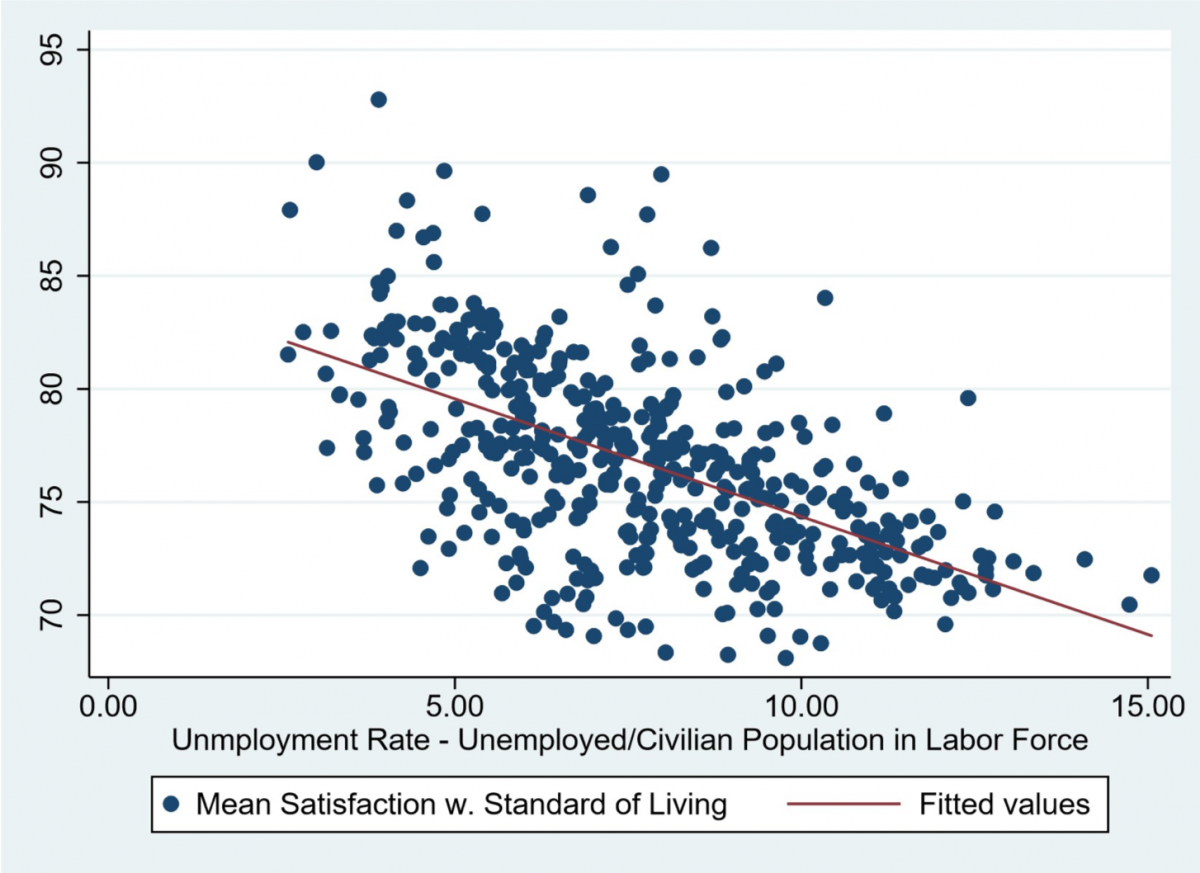

Figure 1. The scatterplot of the SWB index regressed against the unemployment rate in all U.S. states.

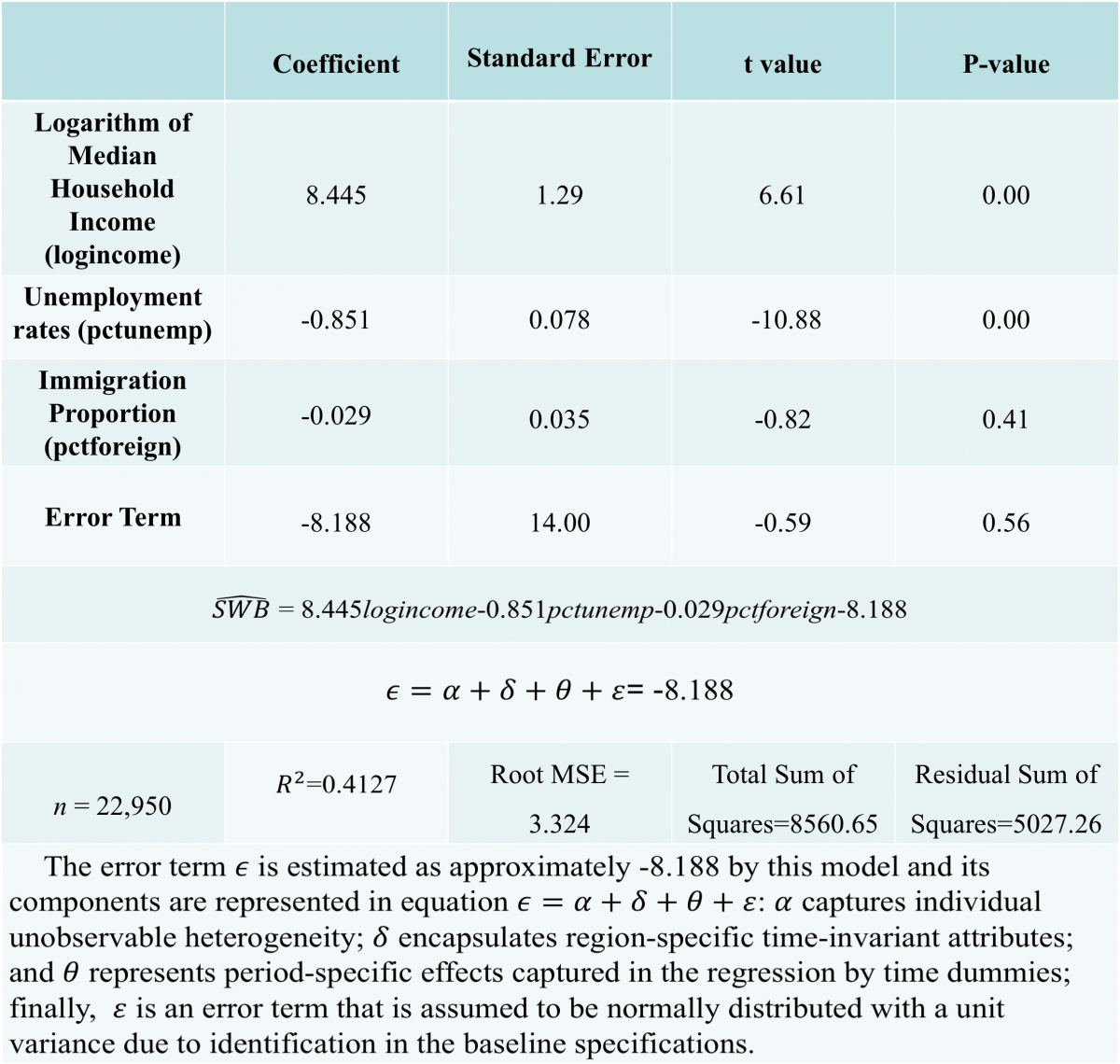

The negative slope coefficient of -0.851 and the significantly low p-value indicate that the percentage of unemployment is negatively associated with the subjective well-being.

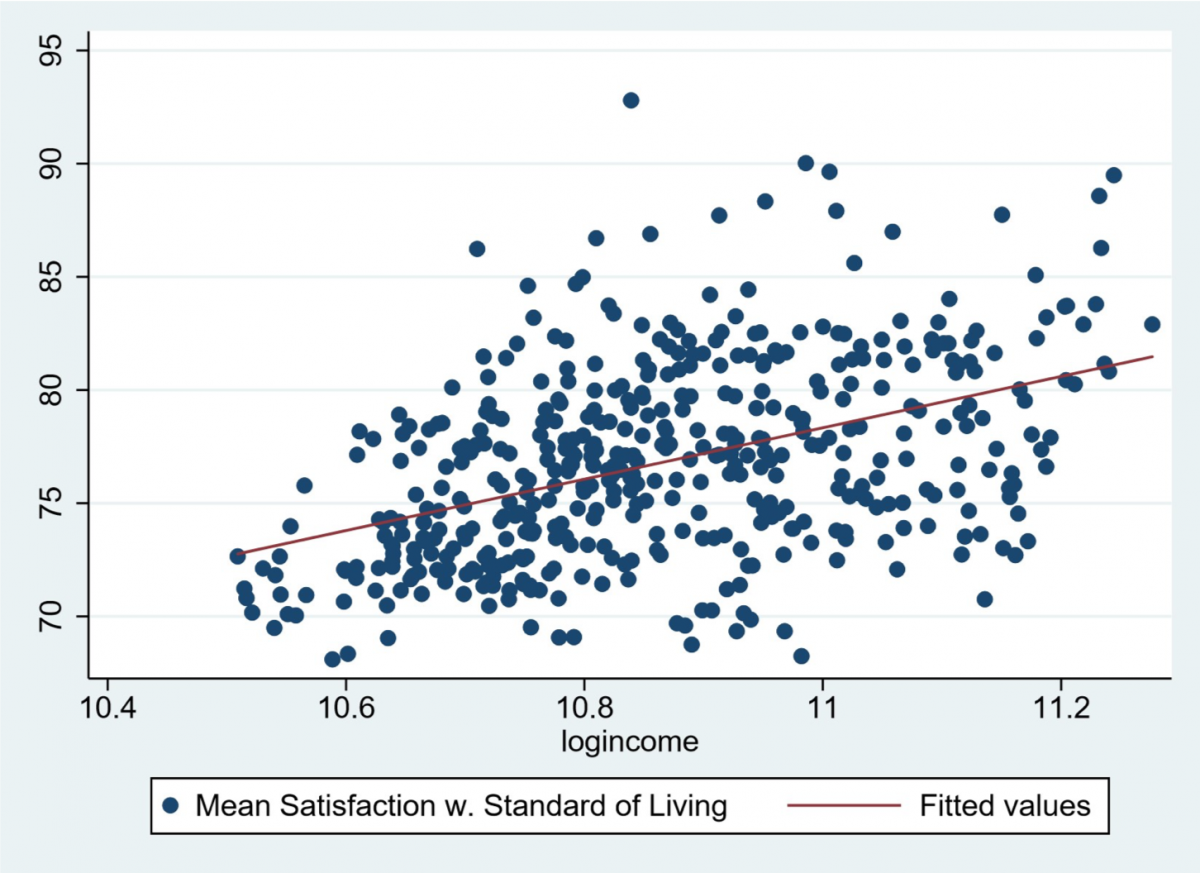

Figure 2. The scatterplot of the SWB index regressed against the logarithm of income in all U.S. states.

The significantly low p-value for the t test implies there is a linear relationship between the income level and the subjective well-being. Moreover, the positive slope coefficient 8.445 suggests that as income levels increase, the subjective well-being levels also rise.

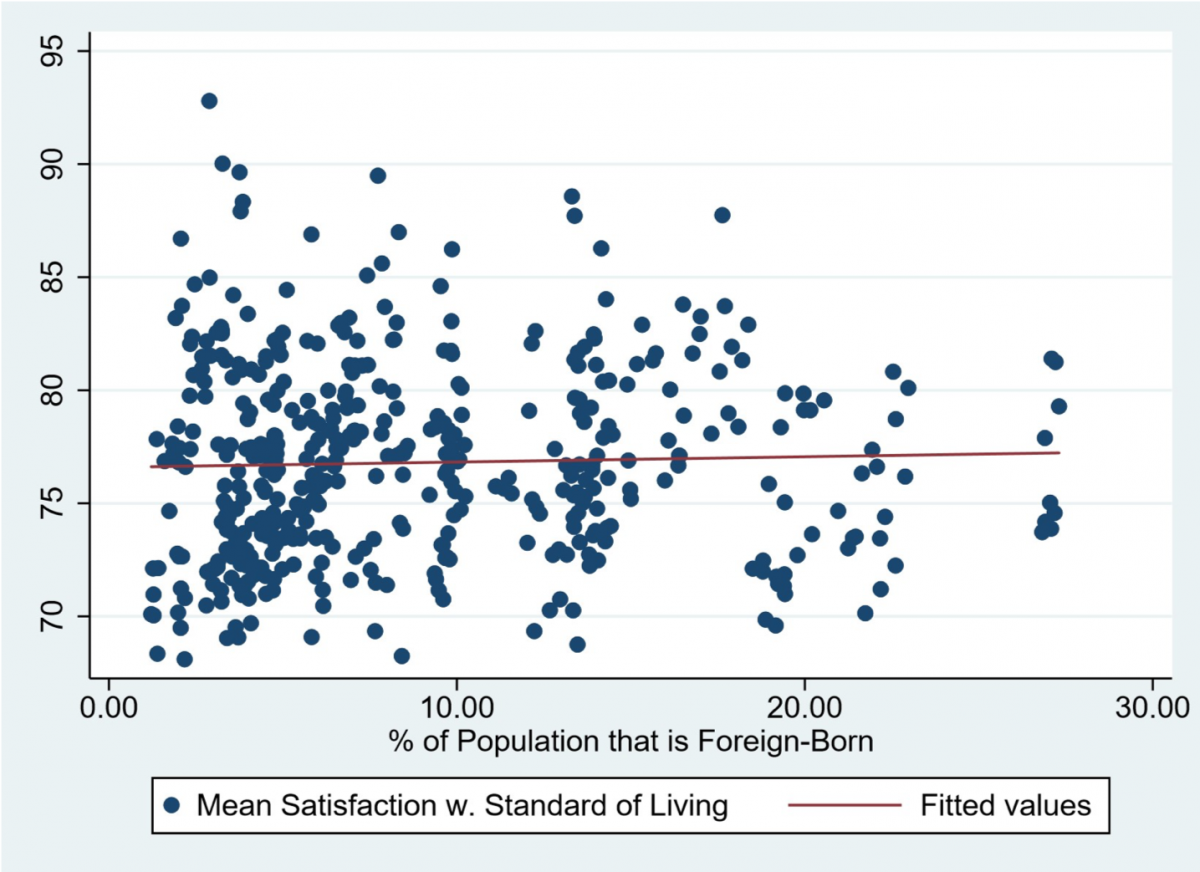

Figure 3. The scatterplot of the SWB index regressed against the immigrant population proportion in all U.S. states.

The slope coefficient -0.029 and the p-value of 0.41 indicates that there is insufficient evidence to reject the null hypothesis that there is no linear relationship between immigration population proportion and the subjective well-being, controlling for income level and unemployment rate.

The multiple linear regression model of the subjective well-being of U.S. natives provides evidence that immigration generates no significant effect on natives’ subjective well-being (SWB), which is consistent with findings of study by D’Amuri et al. (2010). In fact, the subjective well-being levels of U.S. natives are predominately determined by local income level and the percentage of unemployment.

References:

- Sudhinaraset, May, et al.“The influence of deferred action for childhood arrivals on undocumented Asian and Pacific Islander young adults: through a social determinants of health lens.” Journal of Adolescent Health 60.6 (2017): 741-746.

- Case, Anne, and Angus Deaton. “Suicide, Age, and Wellbeing: an Empirical Investigation.” Suicide, Age, and Wellbeing: an Empirical Investigation, June 2015, pp. 2–43., doi:10.3386/w21279.

-

Borjas, G. (2003). The labor demand curve is downward sloping: Reexamining the impact of immigration on the labor market. Quarterly Journal of Economics 118(4), 1335–1374.

- Card, D. (1990). The impact of the mariel boatlift on the Miami labor market. Industrial and Labor Relations Review 43(2), 245–257.

- Card, D. (2001). Immigrant inflows, native outflows, and the local labor market impacts of higher immigration. Journal of Labor Economics 19 (1), 22–64.

- Ottaviano, G. and G. Peri (2012). Rethinking the e↵ects of immigration on wages. Journal of the European Economic Association 10 (1), 152–197.

- Dustmann, C., F. Fabbri, and I. Preston (2005). The impact of immigration on the British labour market. Economic Journal 115(507), F324–F341.

- Manacorda, M., A. Manning, and J. Wadsworth (2012). The impact of immigration on the structure of wages: Theory and evidence from Britain. Journal of the European Economic Association 10(1), 120–151.

- Pischke, J. and J. Velling (1997). Employment e↵ects of immigration to Germany: An analysis based on local labor markets. Review of Economics and Statistics 79(4), 594– 604.

- D’Amuri, F., G. Ottaviano, and G. Peri (2010). The labor market impact of immigration in Western Germany in the 1990s. European Economic Review 54 (4), 550–570.

- Dustmann, C., T. Frattini, and C. Halls (2010). Assessing the fiscal costs and benefits of A8 migration to the UK. Fiscal Studies 31 (1), 1–41.

- Card, D. (2005). Is the new immigration really so bad? The Economic Journal 115(507), F300–F323.

-

Boeri, T. (2010). Immigration to the land of redistribution. Economica 77(308), 651–687.

-

Akay, Alpaslan, Amelie Constant, and Corrado Giulietti. “The impact of immigration on the well-being of natives.” Journal of economic Behavior & organization 103 (2014): 72-92.