Did you know that Pitchbook uses algorithms to identify statistically significant spikes in emerging markets? Pitchbook’s analysts then dive deeper, looking for recent growth in popularity (i.e., what people are talking about, what investors are acting on) in spaces in which there was previously little or no activity prior to a growth period.

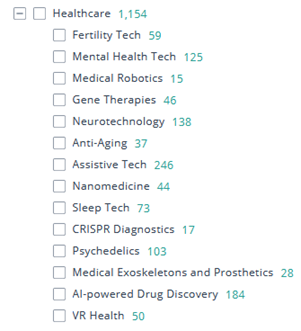

The results are seven emerging spaces: Business Products and Services (B2B); Consumer Products and Services (B2C); Energy; Financial Services; Healthcare; Information Technology; and Materials and Resources. Expand any of the emerging spaces to learn more about where the analysts have identified activity.

View emerging spaces as a heatmap or table, both providing snapshots of the Company Count, Deal Count, and Capital Invested. Drill down further to identify company details, such as which are PC-backed, filter by company location, or deal details, such as deal type, date, or status. Quickly glean spaces to watch by exploring the top 3 companies, the top 3 most active investors, and the most recent deals; additionally link to timely Pitchbook analyst research on these spaces.

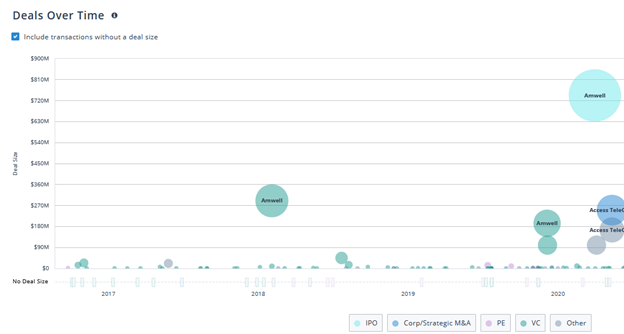

View a bubble chart of deals overtime; screen by type of deal (IPO, PE, VC, etc.), then research specific companies.

Check out this handout to learn about using Pitchbook’s Emerging Spaces feature to identify emerging markets, the companies engaged in these spaces, and the investors and funds investing in them.