Every start-up wants to become the next verb.

“She definitely Photoshopped that image.”

“Do you think we can Uber home from here?”

“Here, let me Google that for you.”

But before any of those companies ever had their names added to the Oxford English Dictionary, they were lean units, not even a fraction of the size they are today. Those small groups of entrepreneurs got to realize their dream through accumulating funding — at first, coming from the pockets of their family and friends, but eventually from dedicated venture capitalists.

The list below will detail each formalized round of start-up funding.

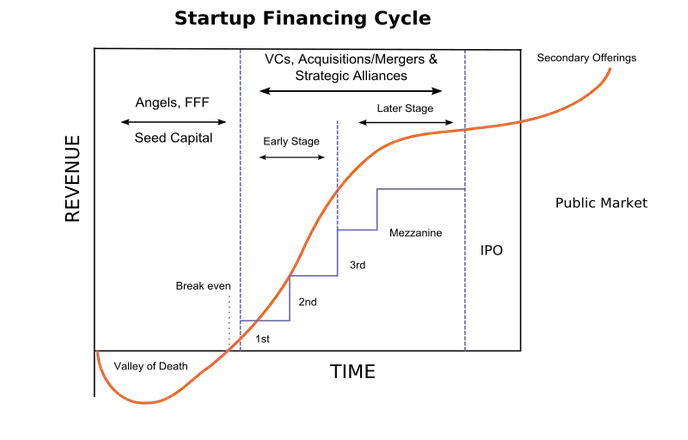

Early-stage funding. Before institutional-sized investors start getting involved, start-ups need money to fund their operations. At the very beginning, that money can come from the entrepreneurs’ own assets — this type of financing is referred to as bootstrapping. Eventually, though, budding start-up teams will need more than they can personally spend, and will start to raise seed money (sometimes referred to as seed funding or seed capital) to keep their business afloat.

Seed money can come from multiple different sources. Friends and family can provide an important stopgap while operating in the red, though it’s important to put your relationships first and let them know the full extent of risk involved. Individual or organized groups of less risk-averse investors, known as angel investors, are important players in early-stage funding. Angel investors can provide larger amounts of capital, but can also bring expertise and experience to an operation that needs it.

But there is a downside to the owners — both of these types of investors are compensated for their risk with partial shares, equity, in the company. Increasing the amount of shares distributed to investors decreases the relative percentage of ownership the founders of the company possess – this process is known as stock dilution. While distributing partial ownership of the company is often necessary and can be profitable, generally the more shares that are distributed overall, the less valuable each share becomes.

Another alternative method of financing is “crowdfunding”, a method that’s become incredibly popular in the past few years through sites like Kickstarter and GoFundMe. Sites like this often attract smaller amounts of capital per investor, but larger numbers of investors. Especially for teams producing consumer technology or games, these sites provide potentially lucrative opportunities. This is a potentially viable strategy especially when considering the dangers of dilution — investors are rewarded in “prizes” with flat cash values instead of partial ownership.

Venture capital financing. After a start-up begins to demonstrate signs of strong performance, much larger, institutional investors known as venture capital (VC) firms may begin to develop interest. With their capital comes the opportunity for structural growth for the company and an increase in revenue. Usually, VC firms will provide funding in multiple subsequent rounds, often referred to as tranches, named in alphabetical order (Series A, B, C, etc.) each with their own risks, rewards, and maturities. Read more about the general structure of VC rounds here.

Further funding. After a start-up successfully navigated to the later rounds of VC funding, the business is likely considering putting out an IPO, or “going public” — but in that intermediate stage, firms may still want to grow their business with more capital without bringing in new shareholders. That’s where mezzanine financing comes in. Firms can receive money in exchange for providing the lender the right to convert any outstanding debt into partial ownership of the company in case of default. Again, distributing equity holds the problems associated with dilution, but for already established firms, this is a highly effective way of getting capital quickly.